Chilly March for real estate

There is a lot of inventory sitting, and very few deals getting done.

March home sales in the FVREB came in nearly 50 per cent below the 10-year average, marking the slowest start to a spring market in over 15 years.

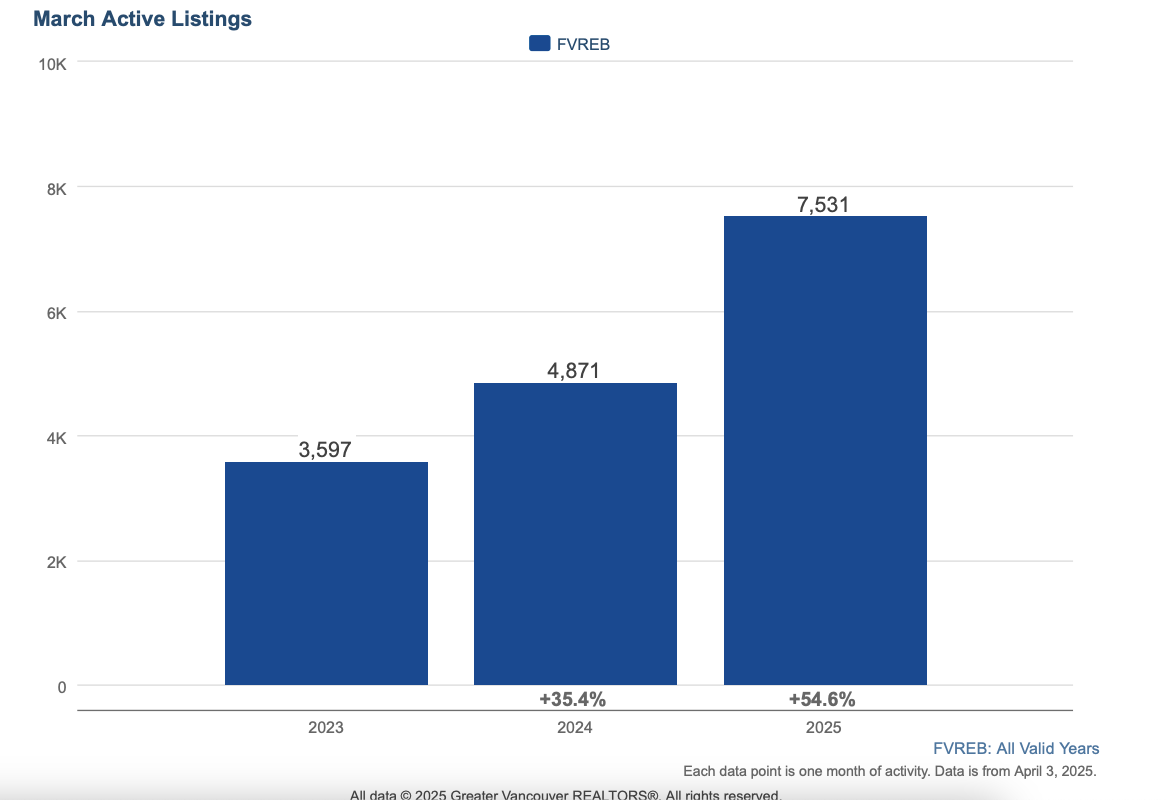

The number of listings on the market is at a decade high. There were 9,219 active listings in March in the FVREB, up 49 per cent from the same month last year and 59 per cent above the 10-year seasonal average.

The sales-to-active listings ratio is sitting at 11 per cent in the Fraser Valley. That’s deep in buyer’s market territory, and even lower than where we were in March 2009. It’s especially unusual to see a ratio this low in March, which is typically one of the best months of the year to sell a property.

Vancouver doing slightly better

In the Greater Vancouver real estate board, the sales-to-active ratio is 14.9 per cent, and sales are only 37 per cent below the seasonal average. That’s still very slow, but noticeably better than what we’re seeing in Surrey and Langley.

Why is the Valley lagging? A few reasons. There tends to be more small business owners in the Valley, and most of the ones I talk to are seeing major slowdowns in their businesses. I think the valley is also more sensitive to the immigration reductions. And we have more new construction, which means inventory piles up faster.

Tariffs, Politics, and Buyer Hesitation

Many people are waiting to see how this shakes out politically, and whether the tariffs are followed through on. Even with 5-year fixed mortgage rates now in the high 3's, almost 2% lower than a year ago, activity remains subdued. That says a lot. Normally, rate drops spark instant demand.

It’s simply a tough environment to sell in. There’s lots of inventory, buyers are nervous, and deals are hard to pull together. Until we get more certainty from the White House, the market will likely remain in this holding pattern.

Months of Inventory is Climbing

This metric tracks how long it would take to sell all the current listings if no new listings came on.

We’re sitting at the highest level of months supply since 2019, just over 7 months. That's a big jump from last spring, when we hovered around 4 months. And if you compare it to the last 10 years, you'll see we're in territory we haven’t been in often.

National Forecasts Point to Early-Year Weakness

TD Economics is forecasting a roughly 4% drop in Canadian home prices this year, with most of the decline front-loaded into the first quarter of 2025.

This aligns with what I’m already seeing on the ground. Most of the listings that are actually selling right now are trading for about 5% less than what they would have gone for last year.

The national data suggests a modest rebound in sales activity and pricing later in the year, but locally, the drag from higher inventory could keep our recovery slower than the national average.

You can read the full TD report here: TD Economics March 2025 Housing Forecast

Featured listing

See below our featured listing,a 4,169 sqft executive townhome in Morgan Creek. The Wedgewood development was constructed around private water features and luscious landscaping, and is a a great option for downsizers or families looking for a low maintenance option at a lower price per square foot than a detached house.